Today’s Currency Exchange Rates in Pakistan – September 29

KARACHI: The State Bank of Pakistan (SBP) released the latest mark-to-market exchange rates for major global currencies on September 29, 2025. These rates help foreign exchange dealers revalue their books daily. The rates are based on the weighted average of the USD/PKR closing rate and global currency values from LSEG Workspace. The US Dollar slightly declined to 281.35 PKR in the spot market, while its one-year forward rate rose to 293.81 PKR.

Gulf currencies remained strong against the PKR, reflecting economic stability in the region. The Saudi Riyal stood at 75.01 PKR, rising to 77.85 PKR over one year. The UAE Dirham opened at 76.60 PKR and reached 80.07 PKR in the forward market. The Qatari Riyal traded at 77.19 PKR in the spot and increased to 80.57 PKR for one-year tenor. The Kuwaiti Dinar remained firm at 922.47 PKR, with a forward rate of 967.51 PKR.

The Euro dipped to 329.64 PKR in the spot market but reached 350.39 PKR over the one-year tenor. The British Pound traded at 377.85 PKR, rising to 393.83 PKR forward. The Bahraini Dinar stood at 746.18 PKR in the spot rate, climbing to 775.72 PKR over a year. Analysts link these shifts to global monetary policies and improved remittance inflows supporting the PKR.

Other major currencies also showed stable movements. The Japanese Yen stood at 1.89 PKR, while the Swiss Franc traded at 352.97 PKR. The Australian Dollar reached 184.75 PKR, and the Canadian Dollar was at 202.12 PKR. Currencies like the Singapore Dollar, Malaysian Ringgit, and Chinese Yuan also held steady levels against the PKR.

Meanwhile, smaller currencies such as the Bangladeshi Taka, Brazilian Real, and Argentine Peso remained limited to spot trading. The State Bank said there is no forward rate available for them. Forward premiums on major currencies reflect a cautious economic outlook, influenced by global interest rate expectations and Pakistan’s fiscal conditions.

Abrar Ahmed shines as Pakistan bowl out South Africa

16 hours ago

NEPRA Announces Rs0.48/kWh Relief for September FCA

16 hours ago

BCCI, PCB Begin Talks to Resolve Trophy Issue

17 hours ago

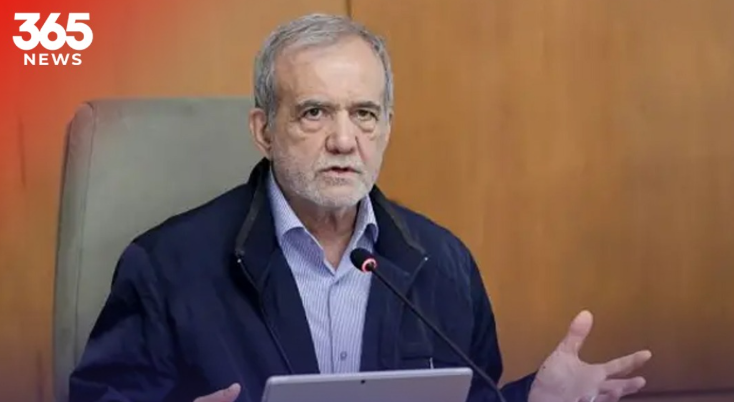

Iranian President Masoud Pezeshkian Tells U.S.: Tehran Won’t Abandon Nuclear and Missile Programs

Tehran : Iranian President Masoud Pezeshkian has delivered a strong message to the United States, saying that while Tehran seeks…

Hamas Hands Over Another Hostage’s Body to Israel Under Peace Agreement

The Palestinian resistance group Hamas has handed over another Israeli hostage’s body to Israel as part of the peace agreement…

Turkey Issues Arrest Warrants Against Netanyahu Over Gaza Genocide

Turkey has issued arrest warrants against Israeli Prime Minister Benjamin Netanyahu and other senior officials for Gaza genocide and crimes…

Israeli Army Chief Orders Immediate Destruction of All Gaza Tunnels

The Israeli Army Chief has ordered troops to immediately destroy all tunnels in Gaza. In a new military directive, he…

Punjab CM Maryam Nawaz Launches Major Health and Digital Empowerment Program

Lahore — Punjab Chief Minister Maryam Nawaz Sharif has unveiled a historic initiative to enhance healthcare, safety, and digital empowerment…

Rapid increase in HIV cases among children in Nawabshah

A serious health concern has come to light in Sindh, as officials have reported a rapid increase in HIV cases…

Dengue and Malaria Cases Continue to Rise in Interior Sindh

Dengue and malaria continue to spread rapidly across Hyderabad and several districts of interior Sindh, as hospitals remain flooded with…

An incident of violence against polio workers in Karachi

An incident of violence against polio workers in Karachi took place in FB Area Block 14, Goharabad. A team giving…

Punjab Doubles T-Cash Card Price, Commuters Concerned

The Punjab Transport Department has raised the price of the…15 hours ago

Abrar Ahmed shines as Pakistan bowl out South Africa

Spinner Abrar Ahmed produced his career-best figures as Pakistan bowled…16 hours ago

DRAP Deregulation Likely to Raise Medicine Prices in Pakistan

KARACHI: Medicine prices in Pakistan are expected to rise further…16 hours ago

NEPRA Announces Rs0.48/kWh Relief for September FCA

KARACHI: The National Electric Power Regulatory Authority (NEPRA) has approved…16 hours ago